Introduction

Mobile banking apps have replaced traditional banking for millions of users in 2025. From checking balances to sending money instantly, banking apps make financial management faster and more convenient.

Below are three of the most popular banking apps trusted by users around the world.

1. PayPal – Global Digital Payments Leader

PayPal remains one of the most widely used financial apps for online payments and transfers.

Key features

- Secure online payments

- Fast international money transfers

- Buyer and seller protection

- Easy integration with online stores

Why it’s so popular

PayPal offers trust, security, and global acceptance, making it ideal for digital payments.

Best for: Online payments and international transfers.

2. Cash App – Simple Peer-to-Peer Payments

Cash App is extremely popular for quick money transfers between friends and family.

What makes Cash App popular

- Instant peer-to-peer payments

- Simple and clean interface

- Debit card and investment features

- Easy setup and usage

Why users choose it

Cash App makes sending and receiving money fast and stress-free.

Best for: Everyday money transfers.

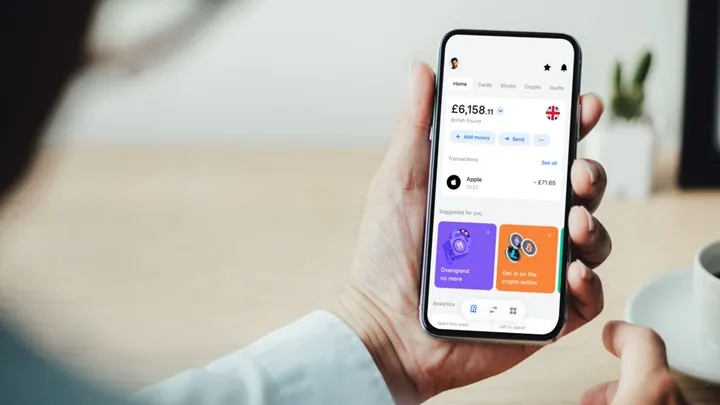

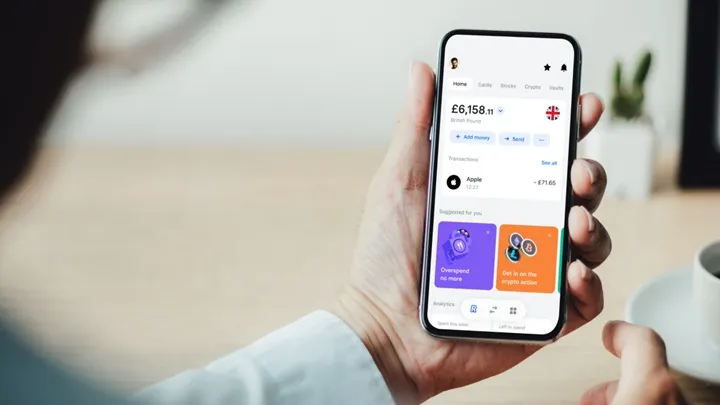

3. Revolut – Modern Digital Banking Experience

Revolut combines banking, payments, and financial tools into one powerful app.

Core benefits

- Multi-currency accounts

- Real-time spending analytics

- International transfers with low fees

- In-app savings and investment tools

Why it stands out

Revolut offers flexibility and advanced features for modern digital banking needs.

Best for: Travelers and digital-first users.

Conclusion

These three banking apps — PayPal, Cash App, and Revolut — continue to dominate in 2025 by offering fast, secure, and convenient financial services.

They are essential tools for managing money in a digital-first world.